Zoho Books Review: Smart Accounting for Small Businesses

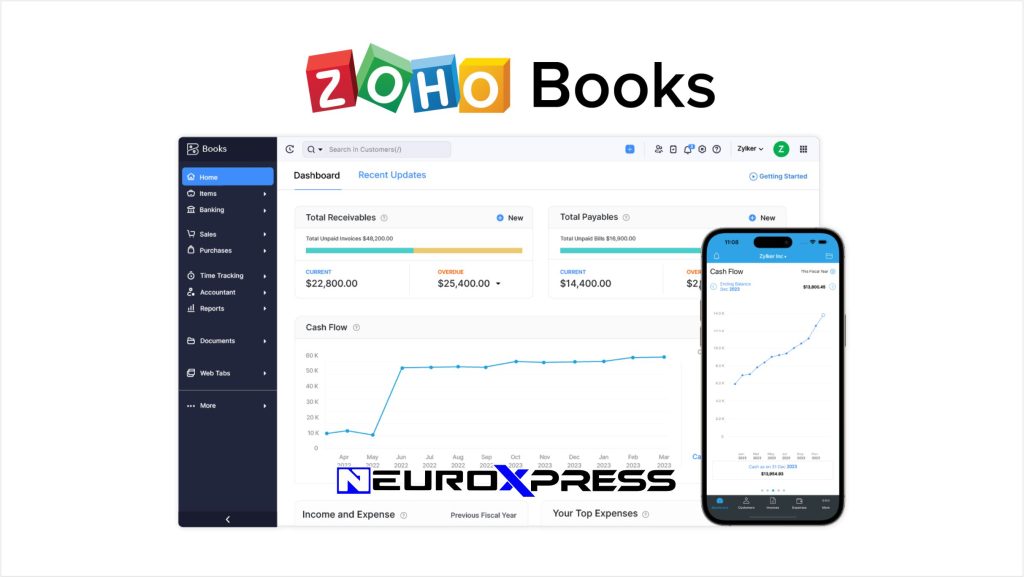

Efficient financial management is key to running a successful business. Zoho Books Review explores a powerful cloud-based accounting solution designed to simplify bookkeeping, invoicing, and compliance. This review will cover its features, pricing, pros & cons, and determine whether Zoho Books is the right choice for your business.

A Freelancer’s Accounting Struggle

Emma, a freelance graphic designer, found it challenging to manage invoices and track expenses. Late payments and tax season were stressful until she discovered Zoho Books. With automated invoicing and expense tracking, Emma regained control over her finances and saved valuable time.

Key Features of Zoho Books

- Cloud-Based Access – Manage finances from any device with real-time data updates.

- Automated Invoicing – Generate professional invoices and set payment reminders.

- Expense Tracking – Categorize expenses and connect bank accounts for automation.

- GST & Tax Compliance – Built-in tax calculations and easy filing for compliance.

- Multi-Currency Transactions – Ideal for businesses dealing with international clients.

- Project-Based Accounting – Track project expenses and profitability.

- Third-Party Integrations – Connect with payment gateways, CRM tools, and e-commerce platforms.

Pricing Plans

Zoho Books offers affordable plans for different business needs:

| Plan | Monthly Cost | Key Features |

|---|---|---|

| Free | $0 | Limited features for businesses with revenue < $50K |

| Standard | $20 | Basic accounting, invoicing, and expense tracking |

| Professional | $50 | Advanced features like project tracking and reporting |

| Premium | $70 | Custom reporting, workflow automation, and integrations |

Pros & Cons of Zoho Books

| Pros | Cons |

|---|---|

| Affordable pricing with a free plan | Limited scalability for large enterprises |

| Intuitive and easy-to-use interface | Fewer integrations compared to competitors |

| Strong automation for invoicing and tax compliance | Customer support can be slow at times |

| Multi-currency support for global businesses |

Who Should Use Zoho Books?

Zoho Books is best suited for:

- Small businesses and freelancers looking for an affordable accounting solution.

- Entrepreneurs needing automated invoicing and tax compliance.

- Startups that require seamless financial tracking and reporting.

- Businesses handling multi-currency transactions.

Conclusion: Is Zoho Books Worth It?

For small businesses and freelancers, Zoho Books offers a feature-rich accounting solution at an affordable price. Its automation, ease of use, and compliance features make it a great tool for managing finances efficiently.

To learn more or start a free trial, visit Zoho Books’ official website today!